Vt payroll calculator

Payroll Payroll in partner with Benefits Time Labor and Human Resources ensures timely and accurate bi-weekly pay for all State employees. To help employers calculate.

Quadratic Keywords Algebra Poster Quadratics Algebra Education Math

Vermont Paycheck Calculator Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Process Payroll Faster Easier With ADP Payroll. DHR-VTHR_NetPay_Calculatorxlsx 1772 KB File Format Spreadsheet Description The Net Pay Calculator is used to figure out what your pay check will be based on.

The results are broken up into three sections. Calculating Withholding Tax Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax. Just enter the wages tax withholdings and.

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the. Get Your Quote Today with SurePayroll. SmartAssets Vermont paycheck calculator shows your hourly and salary income after federal state and local taxes.

Ad Process Payroll Faster Easier With ADP Payroll. Calculating your Vermont state income tax is similar to the steps we listed on our Federal paycheck calculator. Payroll department responsibilities include but are.

The Total Compensation Calculator is used to estimate the pay and benefits which make up the total compensation package for a given position. VTHR is the secure online system for managing employee data and processing payroll. Break up with punch cards timesheets and long days of calculating everyones hours.

Vermont Vermont Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Ad Get Started Today with 2 Months Free. Calculate your Vermont net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Vermont.

Figure out your filing status work out your adjusted gross income. Well do the math for youall you need to do is enter. Welcome to the State of Vermonts VTHR Human Resource information system.

Ad Time and attendance monitoring just got a whole lot easier. Simply enter their federal and state W-4 information as. Vermont Vermont Hourly Paycheck Calculator Results Below are your Vermont salary paycheck results.

Vermont payroll calculators Latest insights The Green Mountain State has a progressive income tax system where the income taxes are some of the highest in the United States. Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Ad Time and attendance monitoring just got a whole lot easier.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Break up with punch cards timesheets and long days of calculating everyones hours. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Vermont.

The Payroll department is responsible for processing salary wage fellowship and special payments for all Virginia Tech employees. Payroll So Easy You Can Set It Up Run It Yourself. Get Started With ADP Payroll.

EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Supports hourly salary income and multiple pay frequencies. Payroll pay salary pay check.

EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Enter your info to see your take home pay. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Vermont.

Ad Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Additionally Payroll validates employee pay for. Back to Payroll Calculator Menu 2013 Vermont Paycheck Calculator - Vermont Payroll Calculators - Use as often as you need its free.

Enter your salary or wages then choose the frequency at which you are paid. Its important to understand your total. Paycheck Results is your gross pay and.

The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending on your income. Get Started With ADP Payroll. As a State of.

Menu burger Close thin. All Services Backed by Tax Guarantee. Vermont Paycheck Calculator Use ADPs Vermont Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Vermont Paycheck Calculator Smartasset

What Time Is It In 2022 What Time Is Conversion Chart Life

Payroll Controller Virginia Tech

Vectoraic 3 Graphing Calculator Graphing Calculator

Monthly Take Home Pay From A 100k Annual Salary Vivid Maps Map Personal Financial Planning Salary

Vermont Property Tax Calculator Smartasset

Technology May Turn You Into A Bigger Tipper Technology And Society Technology Graphing Calculator

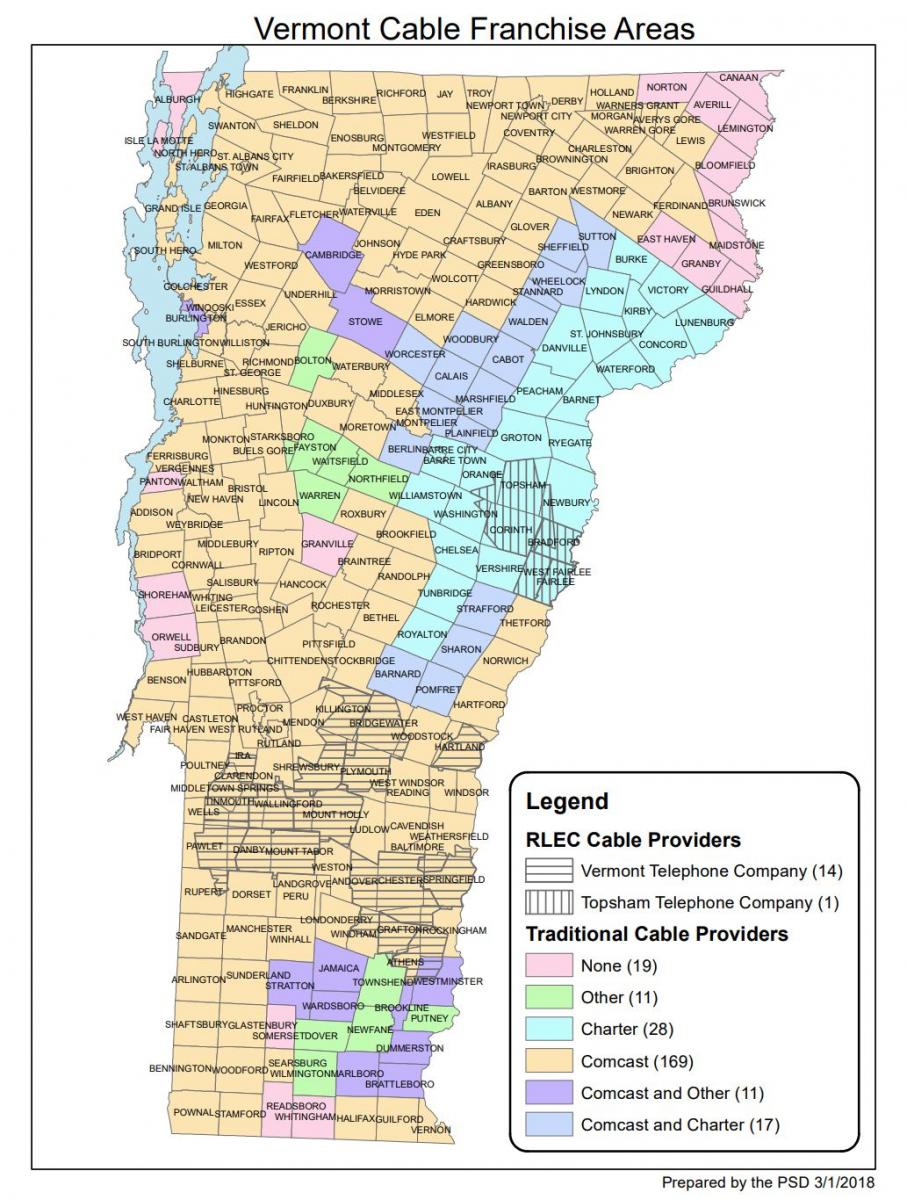

Cable Line Extensions Department Of Public Service

Compare Car Insurance Quotes Fast Free Simple The Zebra Insurance Quotes Compare Car Insurance Website Inspiration

50 50 Profile Virginia Tech Virginia Tech College Rankings Peace Studies

Payroll Controller Virginia Tech

Vermont Postcards X 6 2nd Card Ships Free

Vermont Sales Tax Small Business Guide Truic

Vxus Vs Vt Which Etf Is Right For You

Vermont Paycheck Calculator Smartasset

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Vermont Payroll Tools Tax Rates And Resources Paycheckcity